nc sales tax on food items

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. Items subject to the general rate are also subject.

Sales Tax On Grocery Items Taxjar

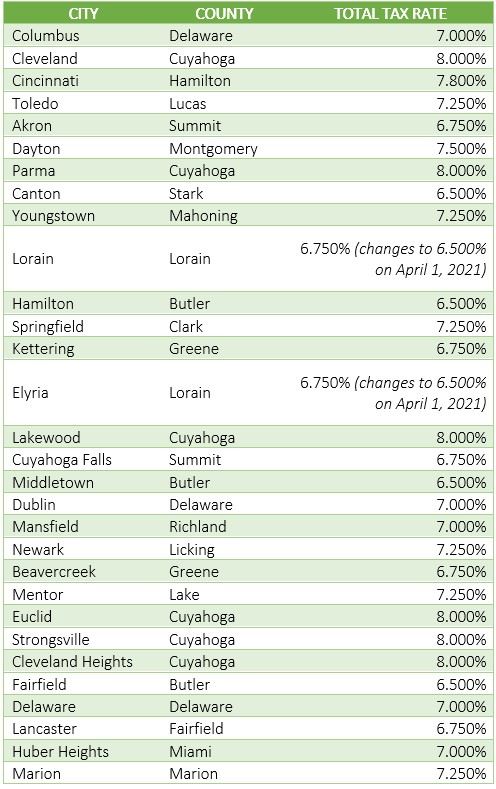

Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax.

. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. Choose Avalara sales tax rate tables by state or look up individual rates by address. The sales tax rate on food is 2.

In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Choose Avalara sales tax rate tables by state or look up individual rates by address. The general sales tax rate is 475 percent.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. North Carolina Sales Tax Exemptions. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Our state sales tax rate is 475 and local taxes can add 2-3 on top of that. Counties and cities in North Carolina are allowed to charge an additional. Sale and Purchase Exemptions.

North Carolina Sales of grocery items are exempt from North Carolina state sales tax but still subject to local taxes at a uniform reduced rate of 2. 21 rows While the North Carolina sales tax of 475 applies to most transactions there are certain. Sales and Use Tax Sales and Use Tax.

The transit and other local rates do not apply to qualifying food. The 2022 North Carolina State Sales Tax. Some examples of items that exempt from North.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. This page describes the. Businesses must add their local sales tax rate to the states rate.

Application of Sales and Use Tax to Retail Sales and Purchases of Food Sales and purchases of food as defined in GS. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. The sale at retail and the use storage or consumption in North Carolina of tangible personal property certain digital property and services specifically.

The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state. Items subject to the general rate are also subject. It is not intended to cover all provisions of the law or every taxpayers.

Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not. Sales Tax Collections on Food and Prepared Food In Millions 1087 1129 1219 1309 1360 1349 177 192 214 235 246 262 0 200 400 600 800 1000 1200 1400 1600 FY2003-04. The sales tax rate on food is 2.

How much is tax on restaurant food in North Carolina. Types of taxes for sales of goods. Candy however is generally taxed at the full.

Counties and cities in North Carolina are allowed to charge an additional. 105-164310 are exempt from the State sales and use. Sales and use tax.

North Carolina also. The Dare County North Carolina sales tax is 675 consisting of 475 North Carolina state sales tax and 200 Dare County local sales taxesThe local sales tax consists of a 200. North Carolina doesnt collect sales tax on purchases of most prescription drugs.

In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax. 40 states tax womens sanitary supplies as luxury items including North Carolina. Sales and Use Tax Rates.

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. The information included on this website is to be used only as a guide. North Carolina has a 475 statewide sales tax rate but also has 458 local tax jurisdictions including cities towns counties and special districts that collect an average.

Is Food Taxable In North Carolina Taxjar

Easley Michael Press Release 2008 07 25 Gov Easley Announces More Savings Offered At N C Sales Tax Holiday Consumers Can Save Even More This Year On Back To School Needs Clothing And Computers Governors Papers

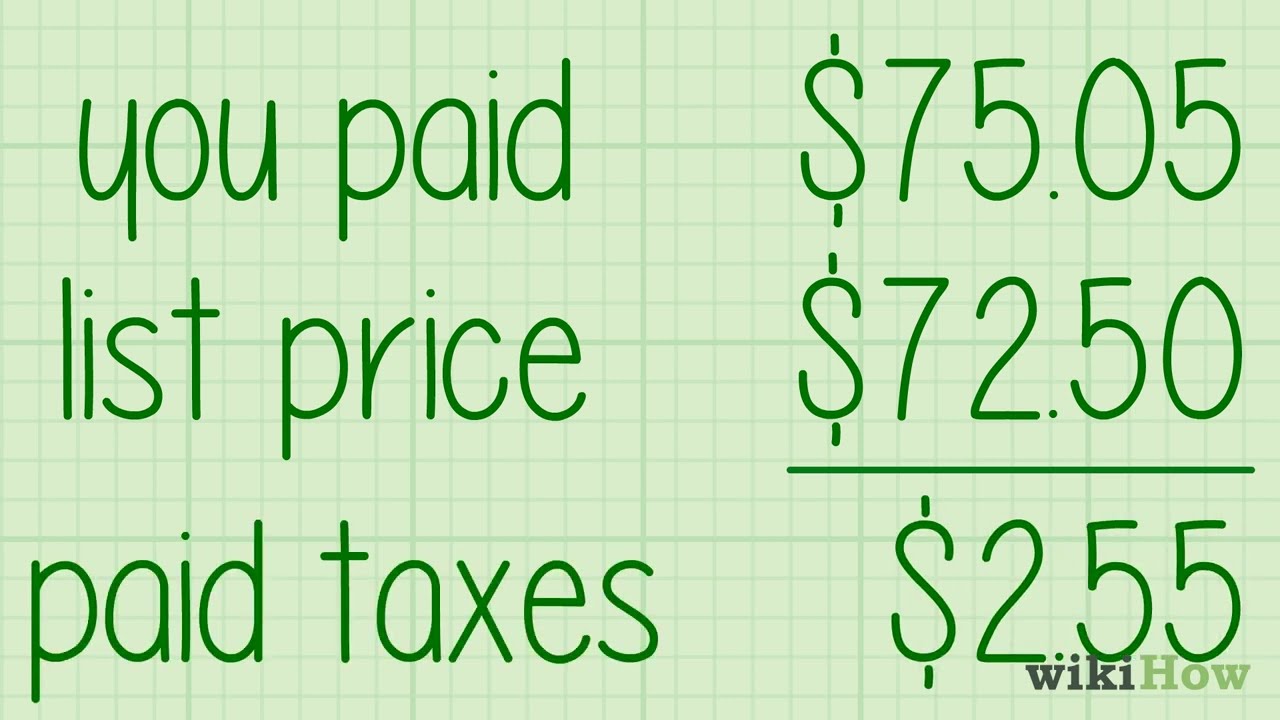

4 Ways To Calculate Sales Tax Wikihow

Is Food Taxable In North Carolina Taxjar

How To File And Pay Sales Tax In North Carolina Taxvalet

Exemptions From The North Carolina Sales Tax

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep

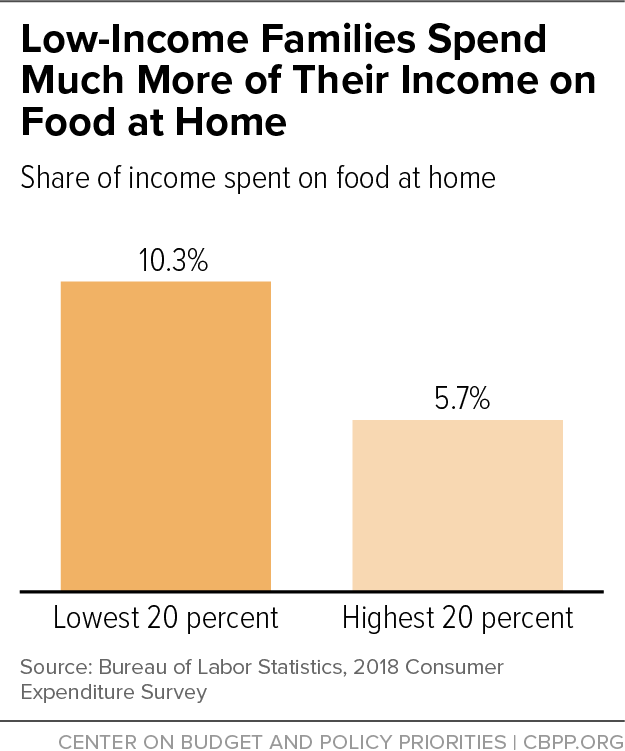

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

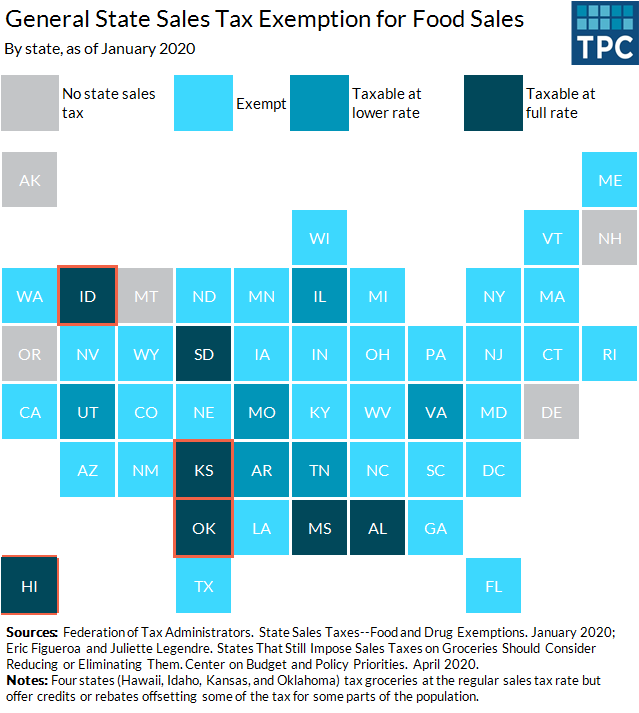

Food Sales Tax Exemption Ff 08 10 2020 Tax Policy Center

Kelly Goes Shopping For Sweet Food Sales Tax Repeal Settles For Gradual Reduction Kansas Reflector

Tax Free Weekend Guide By State 2022 Direct Auto

North Carolina Sales Tax Rate Rates Calculator Avalara

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

A State By State Guide To Sales Tax On Candy Just In Time For Halloween

Texas Sales Tax Basics For Restaurants And Bars Sales Tax Helper

States Without Sales Tax Article

South Carolina Sales Tax Holiday Set For Aug 5 7 Wbtw